What You Have To Know Before Rollover Your IRA / 401k/ Thrift Savings Plan (TSP) Into Gold IRA.

Are you thinking about doing a Gold IRA Rollover or Investing in other pecious metals such as silver and platinum? Before you make the important decision with your hard earned money and savings, be sure you have all the facts and details when it comes to investing your retirement in gold, silver and precious metals.

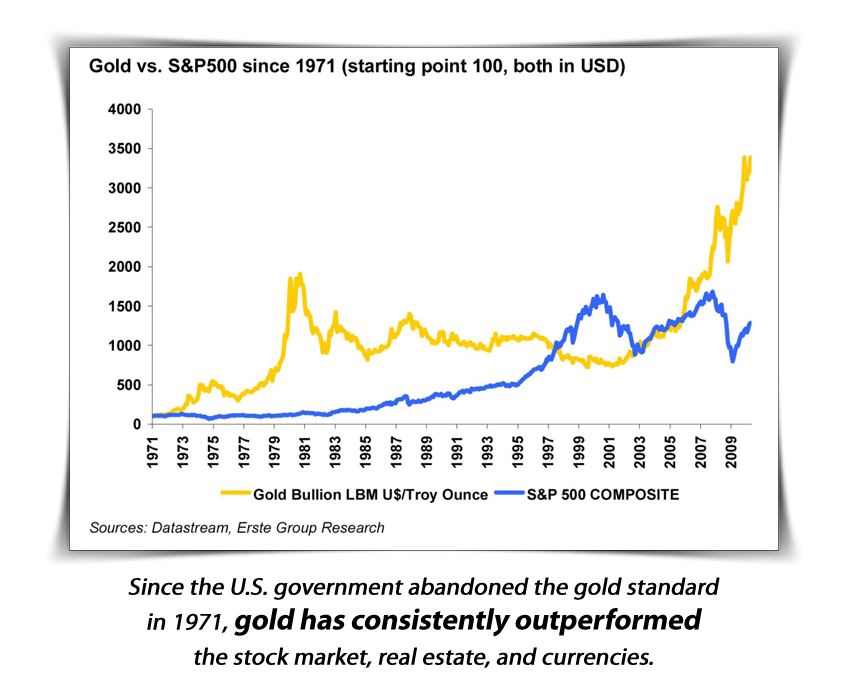

Why You Should Invest in Gold

The most important is to diversify and protect your portfolio. Diversification is the most important component of reaching long-range financial goals while minimizing risk.

The most important is to diversify and protect your portfolio. Diversification is the most important component of reaching long-range financial goals while minimizing risk.

The Stock and bonds are hard to rely on, especially when your entire retirement is resting on its fate. With gold and silver, you know how much money you have and even though it fluctuates – you still have a reliable investment. Gold and silver awalys maintained some value and never gone to zero. Unlike stocks, bonds & etc, there may go to zero.

Gold will continue to hit record high for many years to come if Any of the following occurs:

1) Stock Market Failure.

2) More Foreclosures & Unemployment.

3) Currencies Fail (Including foreign currencies)

4) Inflation & the National Debt Continue to Rise.

Having A Gold IRA Rollover And The Benefits It Will Provide

With the national debt rising literally every second, and our economic growth at just barely above a crawl, it is inevitable that in the near future we could very likely be facing a sort of economic ‘fall out’. When this happens, having investments in Gold are going to be the saving grace to those who have an IRA that is backed by Gold.

With the national debt rising literally every second, and our economic growth at just barely above a crawl, it is inevitable that in the near future we could very likely be facing a sort of economic ‘fall out’. When this happens, having investments in Gold are going to be the saving grace to those who have an IRA that is backed by Gold.

Aside from the fact gold will always be worth more than paper money and coin, there are other important benefits to rolling over your IRA into a Gold Backed IRA.

Every investor’s goal to have a substantial retirement fund that will allow the standard of living today, and hopefully even more. Gold can help immensely because Gold will never lose its value to a point that it will be worth less than the dollar or other monetary funds. In fact as mentioned previously, gold is predicted to continue to rise because of the current trend of an almost failing economy.

There are actually tax benefits when your IRA is backed by Gold. Those who invest in Gold accumulate wealth through Gold investments for years without having to pay taxes on that wealth. How does that work you may be asking? Because Gold is considered a tax-deferred income investment. You only pay tax when you are ready to withdraw your investment in the type of distributions. Investors do have the opportunity to profit from the tax benefit that isn’t applicable to other forms of investment types that aren’t given these tax incentives.

Of course the most compelling reason to roll your retirement plan into Gold IRAs is to diversify, and diversify your retirement savings. Diversifying in general is the one of the key manners to aid in protecting your investment portfolios long-term. So it just makes sense that diversifying with Gold can help prevent losing all your investments should they be only in paper assets like stocks, bonds or mutual funds. Gold is considerably less risky of an investment than those mentioned.

Stocks, bonds and mutual fund’s value rely on the stability of the economy, and as was seen back in 2008 that can be disastrous if all your investments are strictly in paper assets. Having a Gold backed IRA can prevent great or even total loss should that ever happen again. And unfortunately there is a possibility it very well could.

The growth potential for gold is in reality quite good, because when economic instability weakens stocks and bonds, it causes a direct increase in the worth of Gold. When you factor in the knowledge that Gold and other precious metals such as silver can’t be reproduced, their value will continue to rise in the future especially should gold become scarce.

As you can see the benefits of rolling over an existing IRA into gold or starting an Gold backed IRA can in the future be the difference between having a retirement amount that sustains you at the standard you desire for the remainder of your life, or having nothing let to retire comfortably on.

Individual Retirement Account

What really is the smartest way to keep your retirement safe? One of the best ways to save your retirement in this economic uncertainty is by opting for the Gold IRA retirement account.

This involves saving actual silver and gold. Before now, it was not possible for any regular individual to capitalize on obtaining any form of precious metals, however, with the invention of the Gold IRA individual retirement plan, it has become possible.

If you already have your IRA or 401(k) that is locked into one asset class say; mutual funds, you are in dire risk of losing everything you earned from currency devaluation and the likes.

Users now have the ability to change the outcome by opting for a simple IRA rollover which adds diversification to your individual retirement account by including precious metals.

There are several kinds of IRA accounts including;

- Roth IRAs

- 401(k) Plans

- Roth 401(k)

- SIMPLE IRA

- SEP IRA

- 2015 IRA

- HAS

- traditional IRA

- simple IRS

- self-directed IRA

- Thrift Savings Plan (TSP)

What is a Roth IRA

The Individual Retirement Arrangement plan is not taxed as long as certain conditions are met. The law allows a reduction of tax on a limited amount for retirement savings. The principal of this plan is different from most plans as it is tax break is granted on money withdrawn from the plan during retirement.

What exactly is a 401(k) account?

A 401(k) is a form of retirement savings plan that is sponsored by an employer which allows workers save and invest part of their paycheck even before taxes are taken out of it. An employees tax is not paid until the money is remove from the account.

When you opt for a 401(k), you can have control of how your money is invested.

Many available plans offer a spread mutual fund that is composed of bonds, stocks, and money market investments.

A thrift savings plan

TSP is a contribution plan for all US civil servants and retirees and for members of uniformed services. As 2015, there were about 4.8 million participants.

What does a Self-Directed IRA mean?

This is the name attributed to the gold IRA established via a self-directed IRA. It gives all account holders more control over their investment decisions on behalf of the retirement plan. Investments involve; bonds, real estate, stocks and precious metals. Metal funds can be held in this account. Self-directing is a great opportunity and allows investors tremendous latitude in terms of the types of investments available.

Find out if your IRA, 401k, 403b, pension, TSP, 457, 457b or 401a qualifies to roll over into gold, Our FREE Guide walks you through the simple process and answers common questions about gold IRAs.

What Is A Gold IRA?

A precious metal IRA or a gold IRA works in the same capacity as your regular 401(k), only these accounts would allow users hold precious metals such as silver, gold, and palladium in the process of diversification. This is an important step to take because your entire retirement should not be based off a single asset class. It enables you to have accounts with bars and even gold coins that have been approved by the IRS.

These precious metals are usually stored in depositories like Delaware and Brinks for your safety. You also have the opportunity to invest your retirement in precious metals and you can continue to add to it over time.

This policy allows regular individual participate in, and investment originally meant for the wealthy.

However not every IRA account is eligible for the rollover. Only the following are eligible;

-Roth IRA

-Traditional IRA

-SEP

-401(k)

-403(b)

-TSP (Thrift Savings Plans)

-Some annuities

-Pension plans

Download our FREE Buyer Beware guide and learn how to avoid deceptive IRA dealer lies.

How To Rollover Your IRA Or 401K Into Physical Gold & Silver?

Many people are now transfer/rollover portion of their savings in gold to help balance and protect portfolio against economic uncertainty. Gold IRA rollover is obviously one of the easiest ways to these precious metals without spending a dime out of your pocket. If you already own a 401(k) retirement savings account and you desire to gain exposure to gold and silver with no cash out of pocket, one of the simplest things to do is to convert it to a gold 401(k) or a silver 401(K).

Today, you can easily gain access to gold coins and bullion, as well as other precious metals. In other words, you can purchase physical gold for your IRA or 401(k). This can be easily achieved through a self-directed 401(k) or IRA that has already been verified with a trust company.

If you are thinking of how to rollover your IRA or 401K in gold and silver bullion, here is how to get started, however, it is important to know that this will depend on your current situation.

Former Employer

You can roll over your 401(k) into a Traditional IRA if it is from a company or companies for whom you no longer work. Your 401(k) funds can be utilized to purchase Gold or Silver as soon as they have been deposited in an IRA.

In-Service Distribution

It may still be possible to free up your 401(k) funds for a rollover if you still work for the company that hosts your account. This option is technically referred to as “in-service distribution.” One good thing about this option is that it does not function as a loan instead it serves as an actual distribution of funds that can be rolled over to a Self-directed IRA within 60 days. There are no tax consequences attached. Before getting started, it is very important to inquire from your current 401(k) provider if there is an option for an in-service distribution in its plan. If you do not know how to get started, please do ask them so they can guide you through.

Company Owners Can Benefit from Gold 401(k)s and Silver 401(k)s

By starting gold 401(k) and silver 401(k) plans for the company, owners can also benefit from an investment in silver and gold. However, retirement funds can be rolled into the company’s new gold and silver bullion savings plan by both the business owner and employees.

Formerly Request Your Employer

You are certainly left with a few additional options if your company 401(k) does not include an in-service distribution option. If you want to request for the inclusion of precious metals in the company’s 401 (k) plan, then contact your company’s Human Resources Department and plan administrator.

Rollover Your Thrift Savings Plan To A Gold IRA

Did you know that you can rollover your thrift savings plan (TSP) to gold IRA? The TSP has many similar features to a 401k plan. The advantage of rolling over your TSP Plan assets into a self-directed IRA is that giving you full control over which assets your retirement account funds and open up new tax-free investments. You also won’t be charged any additional fees to leave your funds in the Thrift Savings Plan. Click here to read more details on TSP Gold IRA Rollover Guide.

Common Rollover Mistakes & How To Avoid Them

Have you considered rolling your IRAs from a financial institution to another? Perhaps you’re searching for higher returns, a better service or more investment selections. If you roll over the traditional IRA, there are common mistakes you have to avoid. If you do not, you may face unnecessary penalties and taxes.

We’ll show you an overview of the IRA rollover mistakes and help you avoid them.

1) Keeping same assets in the same place

Your rollover from an IRA must comprise of a single property. This implies that you can’t collect cash distributions, buy other assets with cash and roll over the assets into a new IRA. If this occurs, the IRS will view the cash distribution as ordinary income.

How to avoid it

- Do not make rollovers that are more complicated than they should be.

- Keep the process simple by rolling or transferring the same assets into a new plan or IRA.

2) Delaying IRA Rollover decision and execution

For your indirect rollover to be duty-free, you must roll your assets into another plan or IRA within 60 days. If you miss this deadline, you will be made to both pay state and federal income taxes which may be up to 45%, in addition to 10% federal tax penalty for people under age 59½.

How to avoid it

- Transfer or roll your assets directly into another plan or IRA.

- There aren’t any taxes if you do not take control of your funds.

Note that you could pay income tax for both federal and state, depending on the particular state. For your indirect rollovers to be duty-free, limitations and additional restrictions may apply. Please inquire from your tax advisor about your specific situation.

3) Being limited to one IRA-IRA rollover per year

Within a year, after you transfer assets from your IRA or roll over any fraction of that amount, you can’t make another duty-free rollover of any IRA.

How to avoid it

- Fortunately, you can escape the whole IRA one-year limitation issue by moving your IRA funds around tax-free through direct trustee-to-trustee transferals that do not pass through your hands. These direct transfers do not count as rollovers.

4) Rolling assets over too soon

If you’re under age 59½, and you roll your 401(k) plan assets into an IRA, it would be impossible to take out funds from the IRA without having to pay an additional 10% federal tax. However, you may be excepted if your rollover has post-tax contributions which are not subject to early withdrawal tax penalties.

How to avoid it

- Think about leaving your assets in your own employer-sponsored plan until.

- The extra 10% federal tax will not apply, providing you have left your employer, and the separation happens during or after the year in which you attain the age of 55.

Gold IRA Rules

Opening a gold IRA account is the right path to securing a retirement plan with no financial constraints. The account must operate within the set fixed regulatory rules in the financial market. It is also important to ensure that you are up to speed with the fundamental gold IRA rules that are set to govern the IRA account. The coins used must be recognized by the government of the US.

Here are some steps to follow when pursuing Gold IRA Rollover,

1) Right Type of Gold to Invest With

Some of the most popular coins for investing with include; the American Eagle Gold Coin, Canadian Maple Leaf, the Austrian Philharmonic, Australian Kangaroo gold coin, and the American Buffalo.

The only coins that are allowed must be government made that meets certain levels of purity. If one chooses to use bullion coins, they must be ninety-nine percent pure so that they are qualified for the tax deferment advantages. Money in IRA accounts in the US is not taxed.

2) Custodian

The custodian of a gold IRA is a brokerage or a bank that offers guidance and safeguarding the client’s precious metals. Besides, the custodian handles, on behalf of the owner, transactions and tracking of all the documents. The custodian bank will not earn any profits from the customers’ assets but will charge for services offered.

3) Time Limit and the fund withdrawal restrictions

The savings withdrawals in the IRA accounts can only be made at the age of fifty-five points five otherwise penalties must apply. Withdrawals at an age below the above specified age is charged a ten percent penalty plus taxes. The IRA assets are only taxed if you withdraw the money before the specified age. The reason for the above is to discourage the Americans from taking out the money before retirement.

The gold retirement of an individual account rollover can occur once the customer finds trust from the existing IRA and then restores the amount in a different retirement account. The customer must restore the initial record to the new IRA within 60 days.

How To Choose the Right Gold IRA Company

Before choosing the Gold IRA Company, you should research thoroughly in order to identify the most reliable firm and good reputation. The company that one chooses should be willing to guarantee policies, invest your funds well, and provide the best advice on financial matters to the clients. Significant factors to consider while choosing the best IRA Company to choose include;

- Insurance; the firm need to be protected by an insurance institution for compensation in case of losses.

- License; ensuring that the company possesses the right licensing papers by the Internal Revenue Service (IRS).

- 3rd party reviews; reputable organizations will have good reviews by individuals who have had experiences with the company. Authority review boards such as the BBB, BCA, TrustLink and others.

There was complaint that some gold IRA company overcharged and did not give clear, concise explanation of the term “spread” they use to identify their markup. It was found that the company not roll over the full amount to the Gold IRA, but added a 25% mark-up, which they glossed over during the process by using the term “spread.” This customer rollover IRA into gold about $40,000, resulted in mark up charge into nearly $10,000. Click Here For Gold IRA Lies Guide!

You are advisable to ask tough question to Gold IRA company before Gold IRA Rollover. Click Here for Top 7 Question to Ask Gold RA Company.

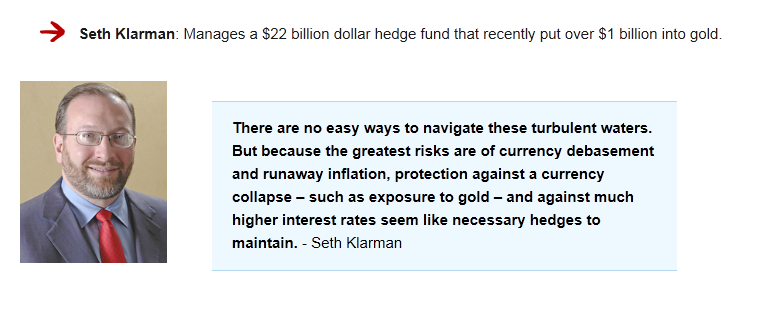

What Percentage of My Assets Should I Hold in Gold?

Ray Dalio: American billionaire investor, hedge fund manager and founder of Bridgewater Associates, has 8% of his portfolio invested in gold, or at least that’s what his “All-Weather Portfolio”, elaborated with Tony Robbins, is allocated into

Jim Rickards: 10% of their portfolio to gold as a hedge against inflation and market volatility. He has also disclosed that he personally holds up to 20% of his portfolio in gold and gold-related investments.

How to Get Started?

Choose The Top 10 Gold IRA Company. If you are seriously considering investing in Gold IRA – such as Augusta, Birch Gold are the place to be. They are one of the best and trustworthy Gold IRA company in United State.

Augusta Precious Metals is a trusted Gold IRA company, known for its positive customer reviews and educational resources. They have 1000+ of 5 stars rating & top reviews from BBB, BCA to Trustlink and others consumer websites. They provide unique, free one-on-one educational web conference designed by Augusta’s on-staff, Harvard-trained economist. Overall, they provide competitive pricing and have zero customer complaints. We encourage you to get Free Gold IRA company checklist, you will not be disappointed. Highly Recommended! Click Here For More Review.

Official website: www.augustapreciousmetals.com

American Hartford Gold was ranked as a top gold company on Inc. 5000’s list of America’s fastest-growing private companies for 2021. They received A+ Rating from BBB,5 Star Reviews from 3rd parties platform such as Trustpilot and google. American hartford gold provide lowest price guaratee & No buy-back fee. Their reps are top notch and spend a great deal of time making sure you understand the product and are getting the process done correctly. Click Here For More Review.

Official website: www.americanhartfordgold.com

Birch Gold Group, founded in 2003, has become a leading dealer of physical precious metals in the United States. They specialize in gold, silver, platinum, and palladium products, offering retirement account rollovers and direct purchases. The company is A+ rated with the Better Business Bureau (BBB) and AAA rated with the Business Consumer Alliance. Known for strong customer service and educational resources, Birch Gold Group has thousands of satisfied customers. Click Here For More Review.

Official website: www.birchgold.com

Noble Gold Investments is known for its top-notch customer service and IRA investment program, making it one of the strongest precious metals IRA options available. It has an A+ rating on BBB, an AA rating on BCA, a five-star rating on TrustLink, and overwhelmingly positive reviews on Consumer Affairs. Noble Gold Investments is a trusted partner for investors seeking to delve into the world of precious metals. Click Here For More Review.

Official website: www.noblegoldinvestments.com

GoldenCrest Metals, established in 2024, is a U.S.-based company specializing in precious metals IRAs. It helps clients diversify retirement portfolios with physical gold and silver. Since launching, it has quickly received positive reviews for its educational approach, regulatory compliance, and secure, pressure-free investment process. Click Here For More Review

Official website: www.goldencrestmetals.com

Lastly, Request a Gold IRA Rollover Kit to learn how transferring your IRA or 401(k) into precious metals can be done without taxes or penalties, as long as it’s done correctly.

Looking for a Trustworthy Gold IRA Company? Download Our Quick, Fact-Based Checklist to Help You Evaluate Ethical Providers...

| Disclosure :The information provided on this website is for educational purposes only. Consult with a financial professional before making any investment decisions. We may be compensated if you use companies, products or services based on our recommendations. Learn more. |

FREE NO-Obligation Gold IRA Guide

Gold IRA Rollover

Gold IRA Rollover